The subscription model is a popular way for businesses to drive recurring revenue. But it isn’t without its challenges. Although subscriptions are, in theory, set-and-forget, not all scheduled payments go through without a hitch. Sometimes, customers need to be reminded to make a payment. Sometimes, they need to be reminded multiple times.

Reminding customers via email to make a payment is known as “dunning”. Dunning will result in a higher payment recovery rate and will reduce involuntary churn.

Unlike voluntary churn, where a customer decides they no longer want to pay for a product or service, involuntary churn is where the customer does not intend to cease usage of a product or service, but due to failed payments, their subscription is canceled. Businesses can lose a considerable amount of MRR due to avoidable involuntary churn, which is why dunning is so important.

In this article, we will share what dunning emails are, who should use them and how to optimize them. Plus, we'll share some real examples of dunning emails.

What is a dunning email?

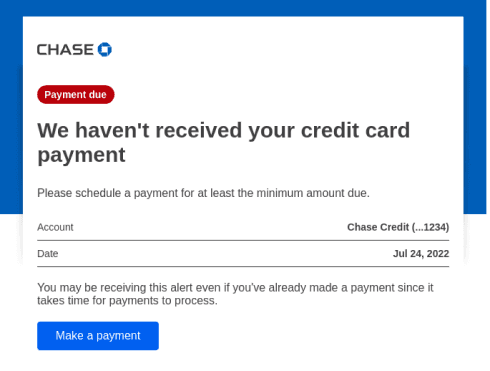

A dunning email is a transactional email (or series of emails) that alerts customers of a failed payment, and asks them to make the payment or update their payment method. Most payment failures occur due to insufficient funds or the card being expired.

If the customer receives a series of emails over a certain period of time but doesn’t take action, their account will typically get canceled or suspended.

You can also send dunning notifications via SMS instead of or as well as email.

Who uses dunning emails?

Any business with a subscription or auto-payment model uses dunning emails to retrieve missed payments. For example, a B2B SaaS company that bills customers monthly would send dunning emails if scheduled payments didn't process. An agency may send dunning emails about unpaid invoices. And an ecommerce brand with a product subscription model would send dunning emails to customers if payment was declined, prompting them to update their payment information.

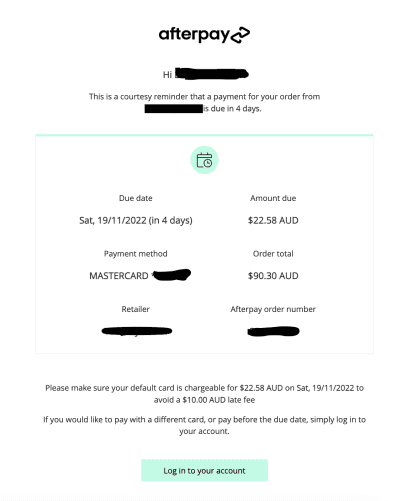

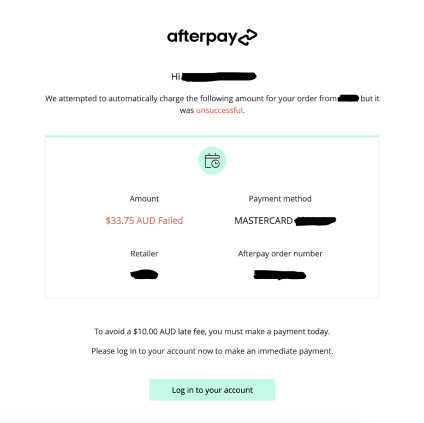

Some companies may also choose to send pre-dunning emails to remind customers of upcoming payments. See an example from buy-now-pay-later service Afterpay below.

As the screenshot shows, the email clearly states how much the payment is, when it is due, and what purchase it pertains to. It also advises the customer that there will be a late fee if the payment does not go through.

How to optimize dunning emails

It’s important to approach dunning emails with care. Asking for money is a sensitive topic and there are many reasons a payment may have been missed. Always maintain a positive customer experience, and do so using the right language and tone. The trick is to be professional and not accusatory.

These tips will help you optimize your dunning emails to improve their effectiveness.

Determine who the email will come from and who it’s going to

Make sure you send your dunning emails from a separate email to your marketing emails. If you choose to use a “noreply” email, remember to provide contact information for your customer support teams, so a customer can easily reach out with any questions regarding their subscription.

Also ensure you are sending the emails to the account owner or identified finance contact, as there is more chance the payment can be arranged then and there.

Include these 5 things in your dunning emails

Include these five key pieces of information in your dunning emails to ensure your customer knows everything they need to make the missed payment.

Why you are sending the email – a customer should be able to understand instantly that they have missed a payment.

The payment amount and how overdue it is – ensure that the payment amount and the date it was due are clear.

How and when the customer should pay – give the customer a deadline to make the payment, and clearly state the available payment methods (i.e. updating credit card information if the card has expired). Note: it should be easy for the customer to make the payment/update their payment method.

A link to login to their account – usually, a customer will log into their account to make the payment or update their payment information.

Make it easy for the customer to reach out – should the customer wish to dispute the payment or discuss it further, provide a link to a customer support channel (this is preferred over providing a phone number as people are weary of scams in emails). Usually, a customer would be able to do this once they’ve logged into their account.

Although there is a lot of information to include, the body of the email should be short, direct, and clear to read. This can be done in a few lines of text.

The contents of your dunning emails will depend on your business (brand guidelines, tone, etc.) and your terms and conditions around missed payments – e.g. whether customers incur a fee for a late payment.

Below are three examples of a dunning email.

Example 1

Hi [first name],

We attempted to charge your card for the payment of [$amount] but it was unsuccessful. This could be due to insufficient funds or your card being expired.

To avoid your account being suspended, please arrange payment before [date].

{Pay now}

For any questions relating to the above, reach out to customer support on [email/phone].

Regards,

[Sender name]

[Sender designation]

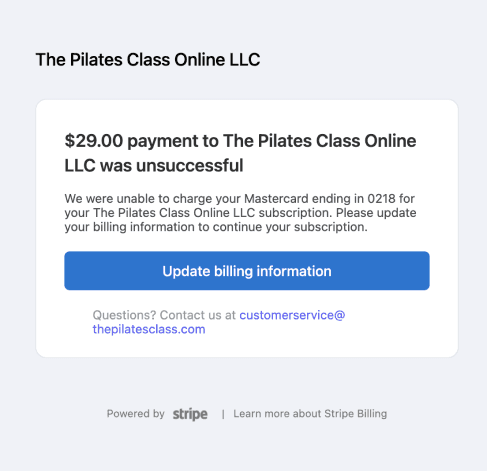

Example 2

[$amount] payment to [company name] was unsuccessful.

We were unable to charge your Mastercard ending in XXXX for your [company name/product name] subscription. Please update your billing information to continue your subscription.

{Update billing information}

Questions? Contact us at [customer service email address].

Example 3

Hi [first name],

We’ve been unable to process your payment for [company name/product] using your card ending in XXXX.

Don’t worry! We’ll try to process the payment again in a couple of days.

If this issue persists, you might need to update your payment information by logging into your account.

{Update payment method}

Card should be working? Drop us an email at [customer support email] and we’ll be happy to assist.

Thanks,

[sender name]

Although the examples above are slightly different in tone (example #1 took a gentle but professional approach; #2 is direct, and #3 is friendly and conversational) they all include the important and relevant information: what is wrong and how to fix it. The tone you choose will depend on your business.

Optimize the subject line

Now you’ve got the body copy down, it’s time to ensure your email will be opened. To improve the likelihood that your dunning emails will be seen, you should optimize the subject line to include all the important, eye-catching information.

To stand out in the customers’ inbox, include the below in your subject line:

Your company name (not using your company name could make the email look generic and more likely to be marked as spam)

Authoritative language (mention that payment has declined)

Personalization (e.g. their first name, the amount they owe or their subscription type). With Ortto, adding personalization to email is easy – we’ll discuss how later in this blog.

Below are a few subject line examples that are sure to get customers’ attention:

Action required: Payment due for [product/company]

[Company name] – Your payment failed to process [ref. No.]

[$amount] payment to [company name] was unsuccessful

[company name] - Payment declined

[First name], you have an overdue payment for [product]

To write the best possible subject line, try Ortto’s subject line AI tool. Not only does it generate subject line suggestions based on AI, it also predicts the open rate, meaning you can be confident your emails will be opened – and you’ll retrieve those missed payments.

Determine email cadence

Devising the right dunning email strategy will improve your payment recovery rate. In many cases, a customer will fix a payment issue after receiving an initial dunning issue. For those who don’t act straight away, you’ll need to send subsequent emails to get their attention.

The best bet is to create a 30-day email playbook and send an email every 3-7 days. For example, you may send emails on day 0, day 3, day 7, day 15, day 20, and day 30.

Each email will have slightly different messaging to capture the customers’ attention. Dial up the urgency by using emotional words like “failed” and “attention”.

Alternative ways to contact your customers about missed payments

If your customers aren’t responding to your emails – or perhaps they aren’t opening them at all, which may suggest they are unaware there is a problem – you may need to contact them via other communication channels.

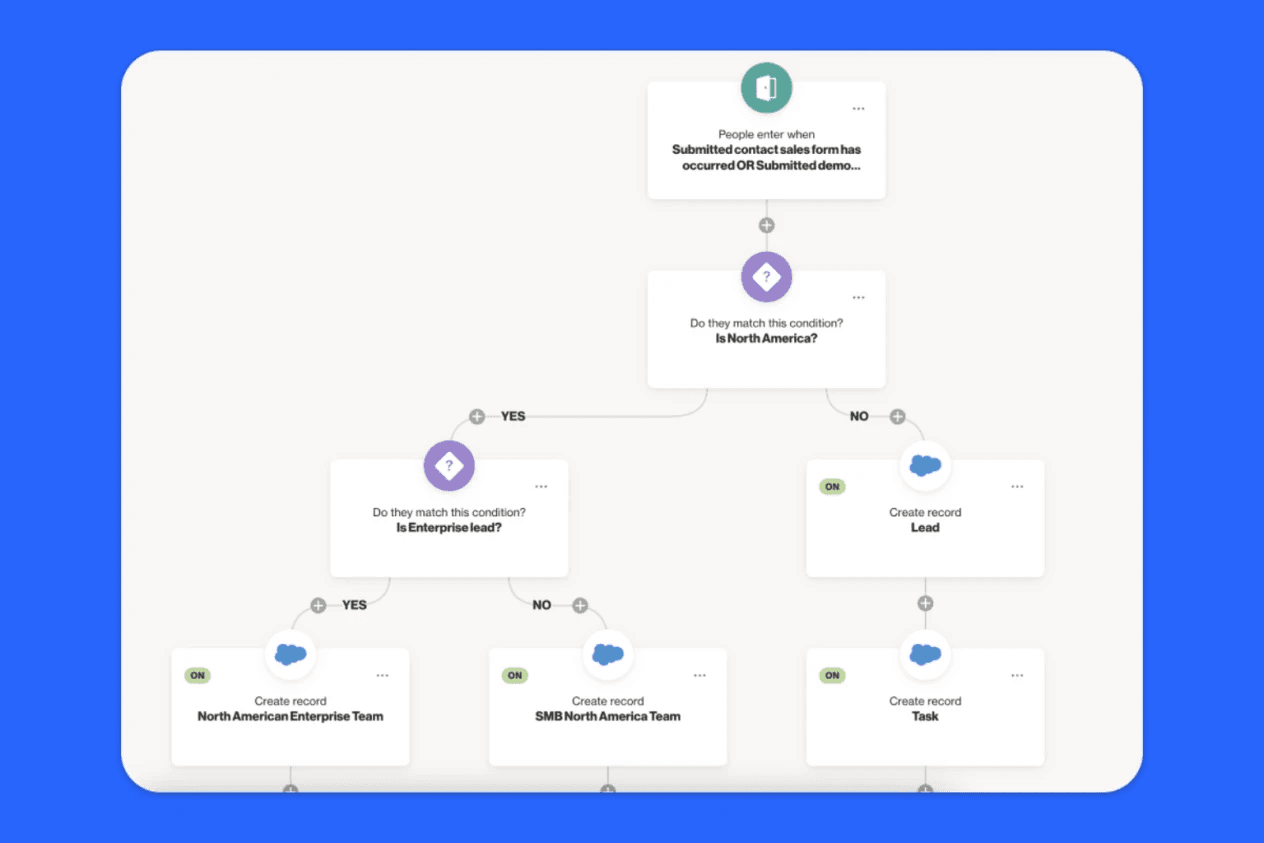

You could use SMS in addition to email to get your customer’s attention. Alternatively, you could use in-app popup messages to prompt them to make a payment. The Journey template below will get you started with an email and follow-up SMS.

In terms of when to introduce additional communication methods into your strategy, it may be most effective after the 2nd or 3rd email rather than as a last resort. SMS has a 98% open rate, compared to around 20% for email, so sending an SMS message as well as an email will make it hard to ignore.

Example of SMS copy at day 7:

Hi [first name], we have tried contacting you via email regarding an overdue payment for [company name/product]. Please log into your account and update your payment method immediately to avoid your account being suspended.

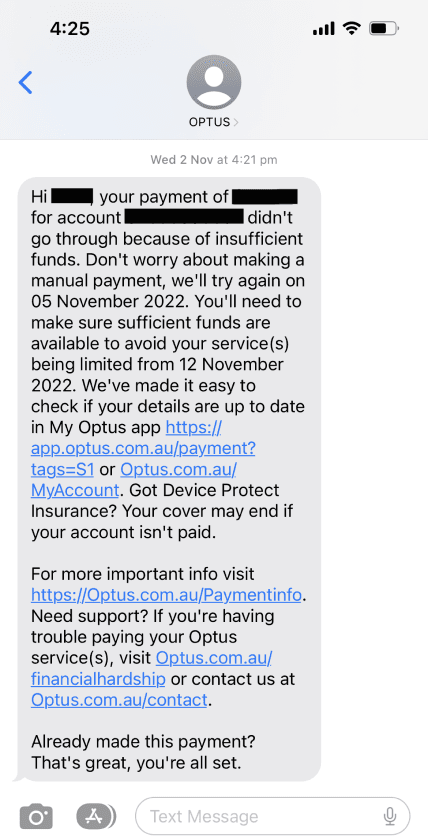

Below is an example from Optus.

Examples of dunning emails

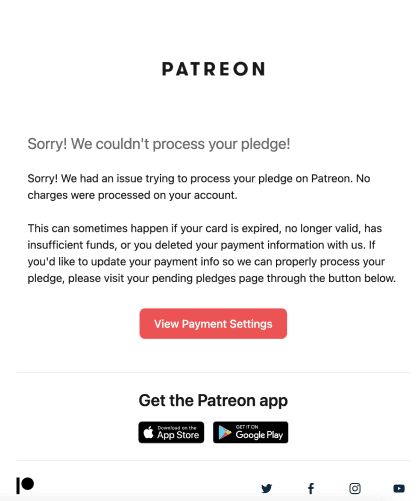

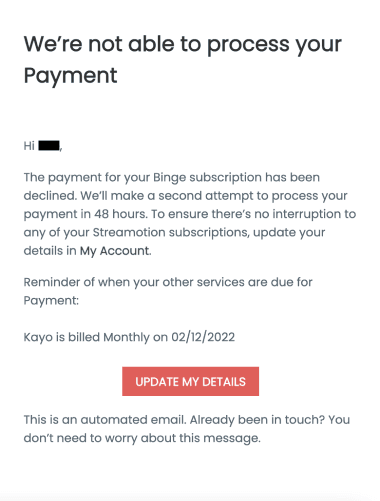

Below are some examples of dunning emails from different businesses across a range of industries.

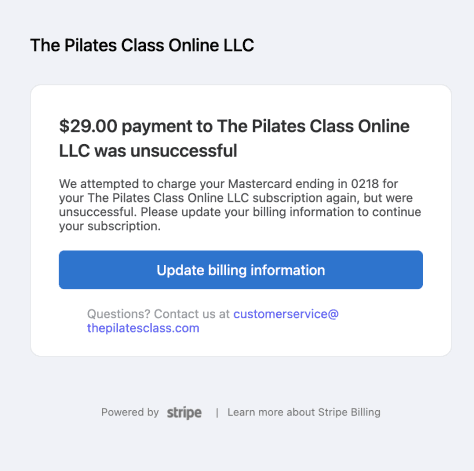

Below are examples of a first and second dunning email from a SaaS fitness company. The emails are similar, but the second email uses more emotional language – “again” and “unsuccessful”.

Final word

Creating the right dunning email strategy can help businesses reduce involuntary churn and, in turn, a loss of revenue.

Blog originally published Nov 22, 2022. Updated Feb 6, 2024

Author

More by Ellie Wiseman

Ellie Wiseman has no more articles